Thursday, July 11, 2024

Music Business

Share

Live Nation Antitrust Lawsuit: Will It Really Lower Ticket Prices?

Live Nation Antitrust Lawsuit: Will It Really Lower Ticket Prices?

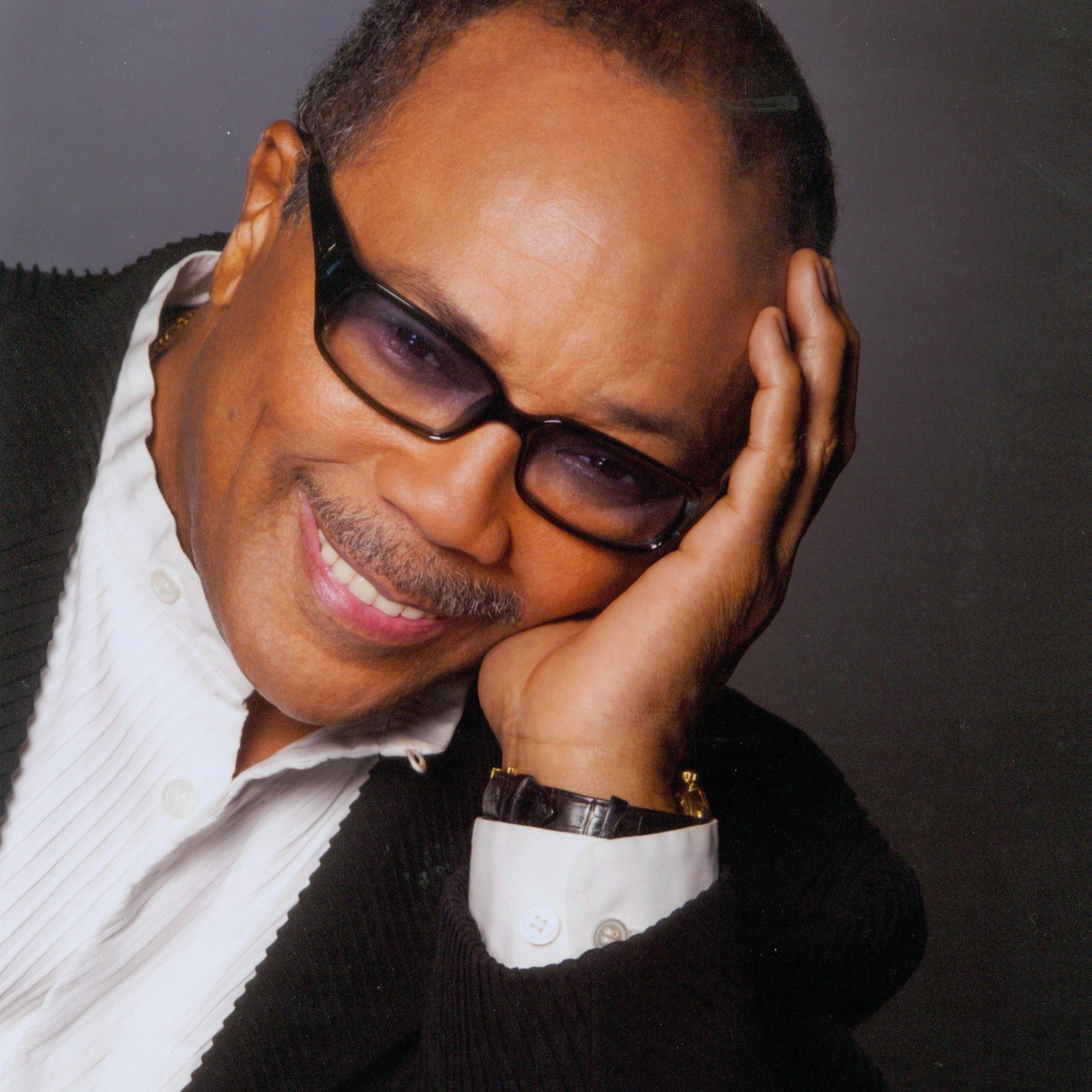

Larry Miller, a professor and director of Music Business at NYU Steinhardt, and the Music Business Association’s Educator of the Year, shares his insights on the Live Nation antitrust lawsuit. As the producer and host of the Musonomics podcast, Miller brings a wealth of knowledge to this complex issue.

The Merger That Changed the Industry

When the Obama administration approved the merger of Live Nation and Ticketmaster in 2010, it envisioned a more consolidated yet efficient market. This vision has largely come true, with increased competition in primary ticketing and the emergence of a massive secondary ticketing market reshaping the landscape.

The DOJ's Surprising Move

The Department of Justice's (DOJ) recent decision to serve Live Nation under the Sherman Act has taken many by surprise. The lawsuit alleges anticompetitive behavior that harms both artists and fans, proposing to reverse the merger that regulators previously approved. However, breaking up Live Nation Entertainment is unlikely to lower ticket prices for fans.

Misplaced Anger at Ticketmaster

Fans often direct their frustration at Ticketmaster, but Miller argues that this anger is misplaced. Artists and their teams set ticket prices, while venues determine fees – not Ticketmaster. The company, which earns an estimated 5-7% of the ticket price for its services, has long absorbed fans' ire while executing the pricing strategies of artists and venues.

The Real Issue: The Secondary Market

To make ticket prices more affordable, lawmakers and regulators should focus on the secondary market. Recently valued at $22 billion globally, the secondary market significantly influences primary market pricing. Artists often underprice tickets to play for genuine fans, but the massive resale market disrupts basic supply and demand dynamics.

The Case of Taylor Swift

Taylor Swift's “Eras” tour saw tickets resold for as much as 70 times their face value. Unlike Live Nation and competitors like AEG, ticket resellers do not pay the artist, venue, or promoter, exacerbating the issue of high ticket prices.

Lessons from International Markets

Australia has capped ticket resales at 10% over face value, and the U.K. is considering similar measures. In contrast, recent U.S. laws in states like New York prohibit such caps, allowing the secondary market to thrive unregulated.

The DOJ's Proposal and Its Flaws

The DOJ suggests that breaking up Live Nation will open up the market for more artists to tour. However, more than half of all artist income comes from touring, and the number of touring artists has significantly increased in recent years. The real challenge for emerging artists is not market access but gaining and sustaining fan attention.

The Tyranny of Choice

The democratization of music production and distribution promised to reach a vast audience at the touch of an upload button. However, the virtually infinite selection of music available on streaming platforms has made it harder than ever for new artists to break through, a phenomenon economists call “the tyranny of choice.”

Live Nation's Role in the Industry

Live Nation has been both an aggressive competitor and a crucial investor in improving the artist and fan experience. Independent promoters criticize the company's business model, which leverages scale and capital to secure long-term, exclusive venue agreements. While Live Nation executes its model effectively, the broader issues causing fan frustration are not solely attributable to one company.

A Call for Comprehensive Solutions

To truly fix the live concert business, policymakers need to address the realities of supply and demand, help artists secure a larger share of their touring income, and regulate the secondary market. Focusing on antitrust litigation against a single company may miss the broader opportunity to ensure a healthy live entertainment ecosystem.

Conclusion

Getting the live music industry right is crucial for artists who rely on touring, fans who value in-person entertainment, and the economic vitality of communities dependent on live events. Policymakers must correctly diagnose the problems facing the industry and craft solutions that address the root causes rather than opting for quick fixes.